01.

Can’t tell the future? Look to the past.

Past Performance is no guarantee of future results, and there is no way for anyone of us to be able to guess the future. Anybody who says they think the market is going to do this or that sometime in the future is about as accurate as a fortune teller. What we can do is look to what we know, what has happened in the recent past, and our experience from similar times. Knowing that we do not know the future, is one of the most fundamental doctrines a good money manager uses. Rather than trying to guess what is going to happen we can instead do two other things.

First, in times of uncertainty or perceived danger, hedge. Have some way to protect your assets on the down side even if it simply means sell some positions and set some money aside.

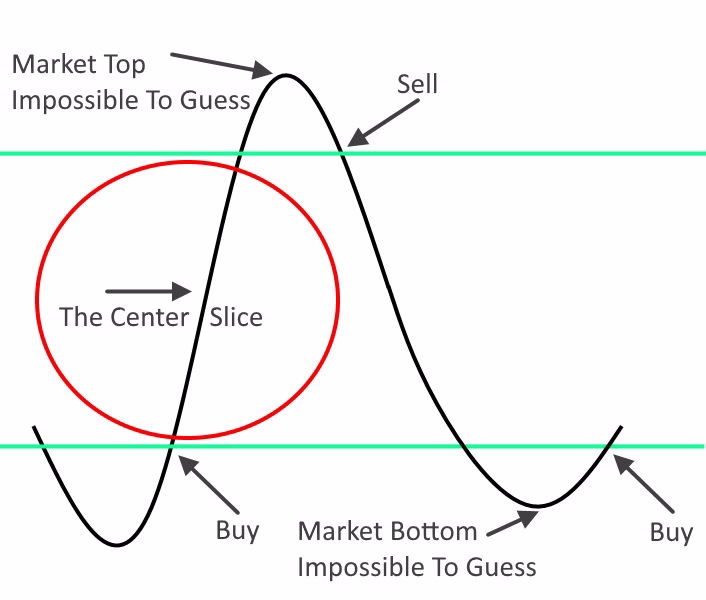

Second, rather than guessing the top or the bottom of a cycle, react to a decline from a steep top, or a climb from a steep bottom in the market, while remaining proactive and engaged all day every day. The graphic example above illustrates this technique we call the Center Slice, meaning don’t try to be a hero and make every dollar. Instead seek good momentum opportunities and seek to earn profits by working with the market; we call this "The Center Slice".

02.

Momentum.

Follow the money is an old saying but it is still very true. At any time some sector of some market somewhere is leading the markets up and another is likely leading the markets down. This may be regional or may be due to social geopolitical pressures, it could be a particular sector in a particular economy or it may be just a technical adjustment, but, in our view, there is almost always a right and a wrong place to invest.

We believe that searching on a continuous basis for the sectors and areas that are leading the markets up is one of the most important parts of asset management.

03.

Our Take - News does not matter.

In our view, the market does not care about news for more than few moments because a few moments latter the market has adjusted to whatever was (past tense) news and that affect is now priced into the market. The market is a forward-looking discounting mechanism, meaning it only really cares about what it does not know and it discounts current prices for future expectations.

For example, why does a person invest in something? Because they expect that thing to be worth more sometime in the future, so that person is discounting the current cost for the expected return in the future… forward-looking.

We believe, the market above all hates uncertainty, so look for period potential cyclical change and be prepared to act fast.

04.

Be cautious when everyone is very happy.

When everybody is talking about how good things are and how much money they are making and saving it is probably a very good time to start looking for a decline.

As economies heat up and money loosens up, excesses build in markets. Remember the Dot Com craze of 2000, or the Real-Estate boom of 2008? When something seems too good to be true it probably is. This condition however can be (and often is) sustained for prolonged periods of time, and it is usually a period of time when the best profits can be made but usually some of that profit at least will be lost when the decline comes.

Just know that whatever systemic risk is involved the excesses may already be in there, hiding, rotting the market from the inside and it will take some simple catalyst to trigger the usual crash that follows.

05.

Be excited when everyone thinks it’s the end of the world.

When when the herd finally capitalizes and sells, and promises themselves they will never invest again or decide they have lost so much they will just ignore their finances and hope it goes away (there is the ostrich again), we may have reached a point where we have begun to run out of sellers.

This creates an imbalance in the supply versus demand efficiency where even a few buyers can easily drive the markets up. In other words, when few want to sell, we likely have reached a cyclical market bottom. From there we need to see some of the lucky or smart investors that did not loose their money because they were in some way hedged (protected) start to pick up shares. After some period of time it becomes evident a bottom may have (past tense again) formed and it is probably a good time to start slowly reinvesting.

06.

Always be ready to run (hedge) and raise cash to protect your portfolio.

Never be afraid of how much money you will not make. Instead worry more about not loosing your life’s savings. Greed, lack of commitment, and poor knowledge of what the investor owns are the most fundamental and common causes of market losses.

Know what you own, believe in it, because you are properly informed about it. Staying so informed every day, and being willing to admit when it is time to change and do it, is a great skill. Do it, don’t sit there hoping it gets better because it sometimes does not.

Don’t be an ostrich. Know that if you sell and it turns out the market does not crash you are allowed to reinvest so you lose nothing except some extra profit, but if you stay put like an ostrich with its head buried in the sand, and do nothing about reacting to a market decline then you may reap what you sow…

07.

It’s not an exact science.

Money management is far from perfect, there are times of great success and jubilation and times of great distress and disappointment. Many Money managers have great years, horrible years, and years in between.

Accept that the best we all can do is our best and nothing is ever guaranteed. Recognize when you are "out of tune” with what the markets are doing and be willing to change, adjust, regroup, and find another way forward. This is a fundamental truth about what it is to be a money manager.

08.

Most of all remember that asset management is really risk management.

In our view, don’t worry about profits, the market will take care of that for you in time. Worry instead about losses and possible risks and think about: if a steep decline happens, how are you protected at least partially is some way from it, such as are you hedged with some liquid cash?

Are you diversified, or are you too concentrated?

Are you able to hold through steep losses or would it be safer and healthier to rebalance?