Living financial plan: An ever evolving statement of an individual's long-term objectives, detailed savings, and investing strategies for achieving them.

The Goal of Financial Planning

Over 40 years ago Paul coined the phrase “A financial plan without a concept is like a ship without a rudder. It will never get anywhere except by accident”. It was true then and even more so today.

Financial planning creates an ongoing living process that should reduce your stress about money, support your current needs, and build a nest egg for pre or post retirement.

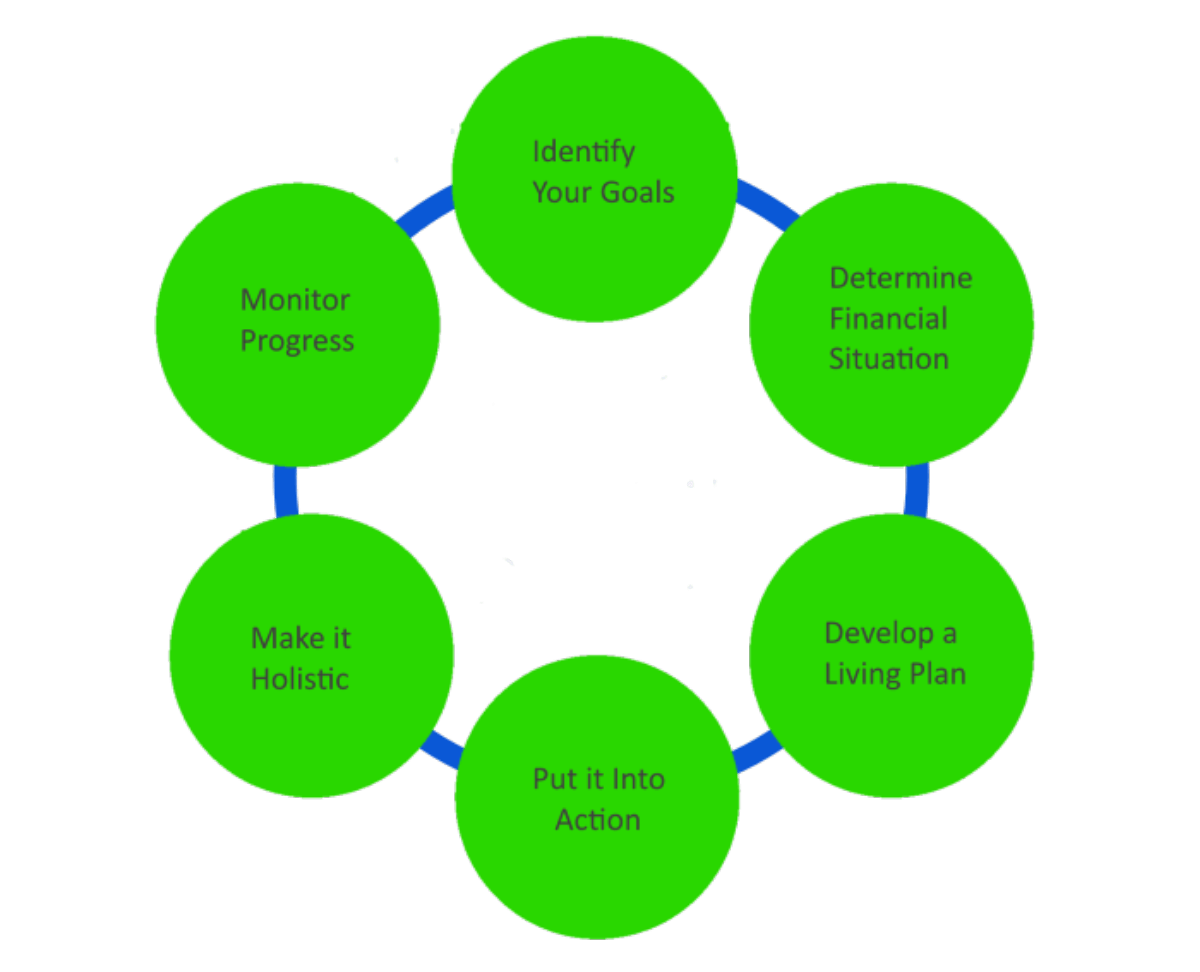

We will nudge you to answer questions about your income, spending, and goals. The living plan will help determine how much money you’ll need to reach those goals, then guide you through the steps you need to take to get there.

Planning creates a roadmap to your finances, potentially maximizing each dollar no matter how many you have. Equally important, a living financial plan serves three very important functions:

First, it becomes a living report card. as needed we can revise the financial plan and ask the questions such as; "How are we doing? Did we meet the goals we had set for the last year? Are we ahead or behind target and were there any changes that require us to update the plan?".

Second, we can use the financial plan as a stress test system, creating scenarios specifically designed to stress your finances and uncovering under what circumstances will your plan fail and what we can do about it right now to mitigate those undesirable outcomes.

Finally, a properly laid out financial plan can create a license for our client to feel more comfortable spending some of their assets on living benefits. Such examples are buying that vacation home they always wanted or helping a grandchild graduate from college.

For our typical client financial planning is less about figuring out how to save for the future and much more about stress testing the existing finances to to help determine if they are adequate for the client’s future financial needs, and creating a license for the client to feel more comfortable with enjoying some of the benefits their accumulated assets can provide. As we always say, “you spent your life saving for a rainy day, now it’s pouring outside" what are you waiting for?